How does Private Rental Select work?

Private Rental Select shares a lot of the DNA of our other structural warranty policies. It can include:

- Cover for up to 12 years, backed by A-rated insurers for complete peace of mind

- Cover for electrical and mechanical installations for five years from completion

- Continuous structure limits of up to £25m for new-builds, with higher limits available on request, and £5m for conversions

- Contaminated land, alternative accommodation, additional fees and debris removal also included

Where it differs from our standard Private Rental policy is that it is designed for multiple rental units that you find in typical build-to-rent schemes.

So the contractor, developer or owner/investor is issued with a single policy covering the whole of the build-to-rent scheme. There is full risk transfer from Day 1, meaning there’s no need for contractors to sign complex indemnity agreements.

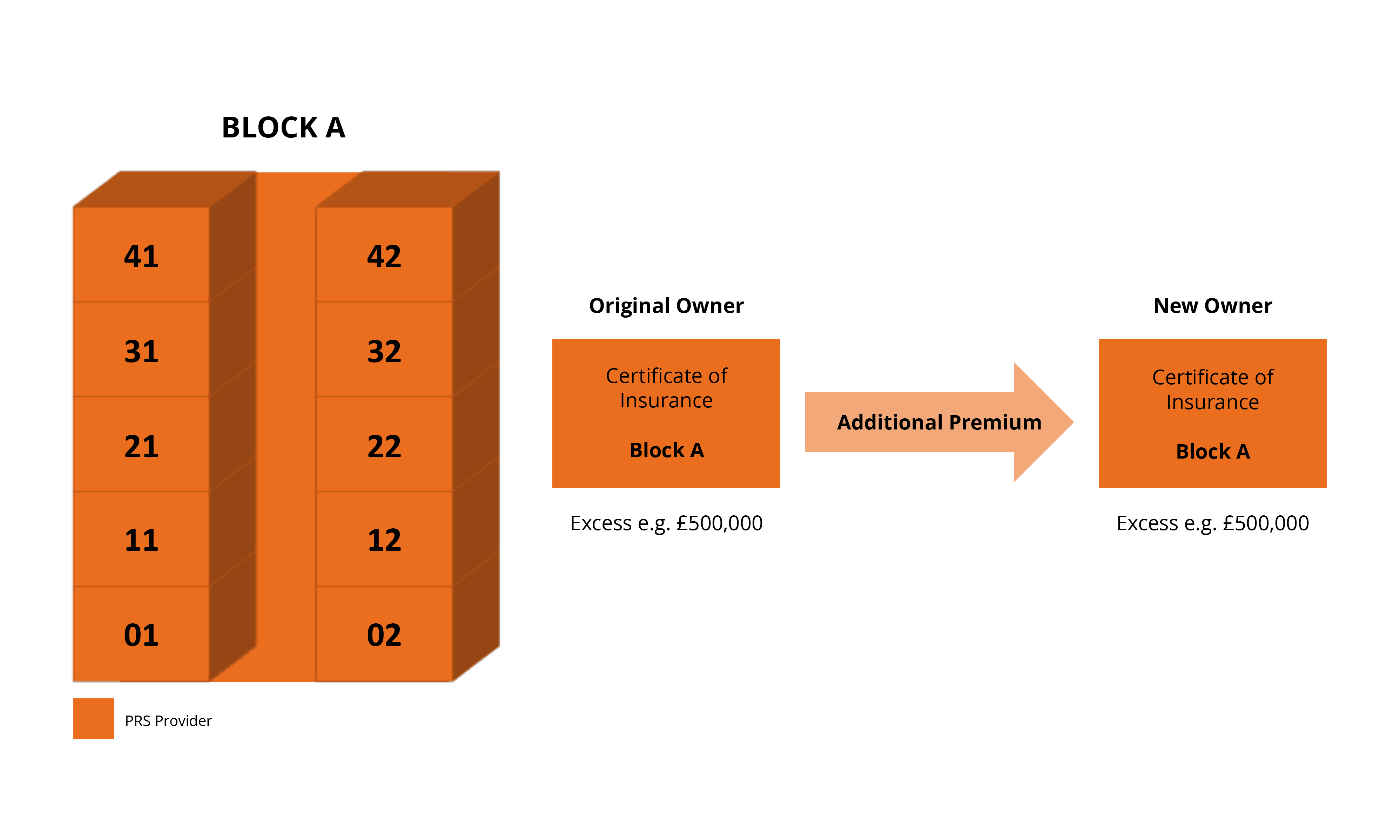

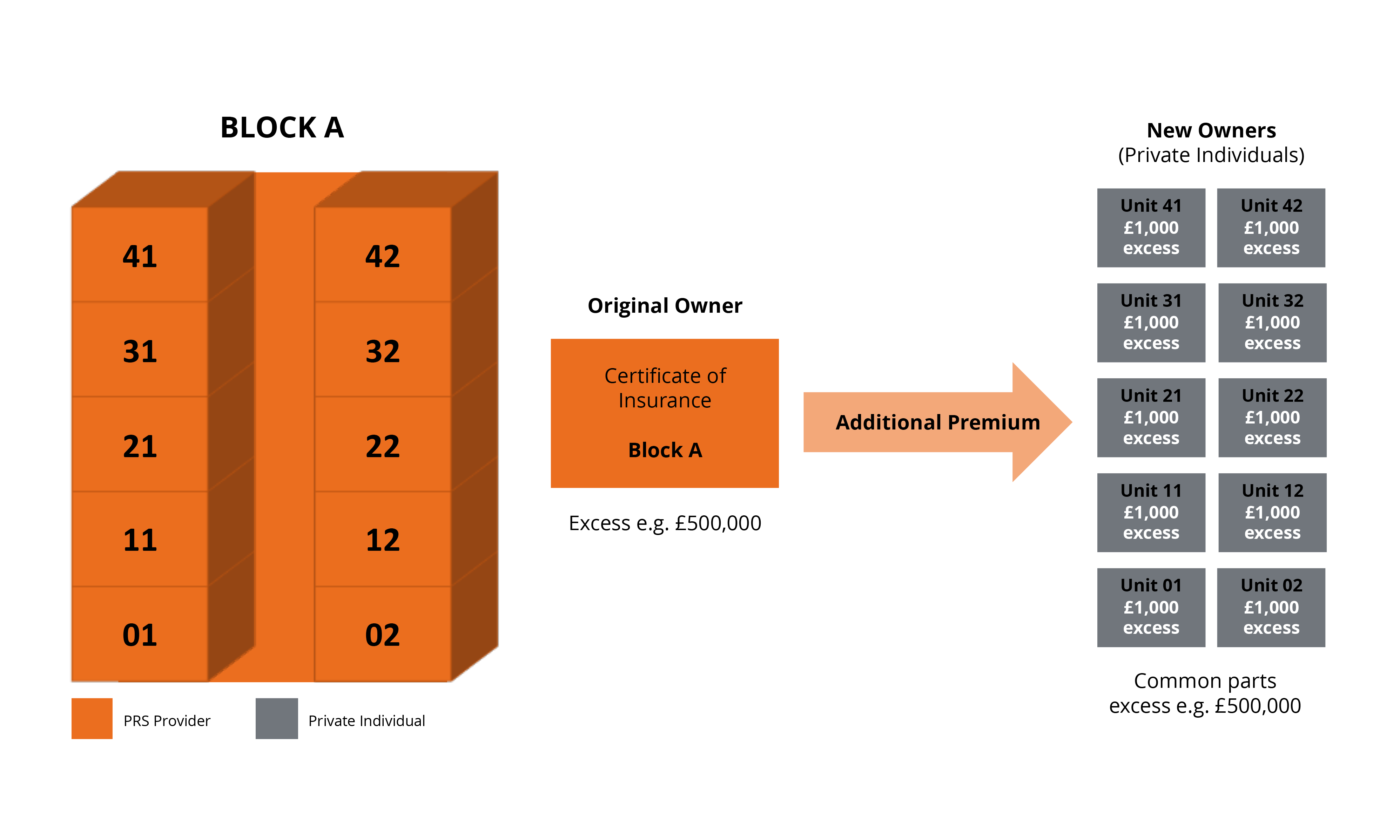

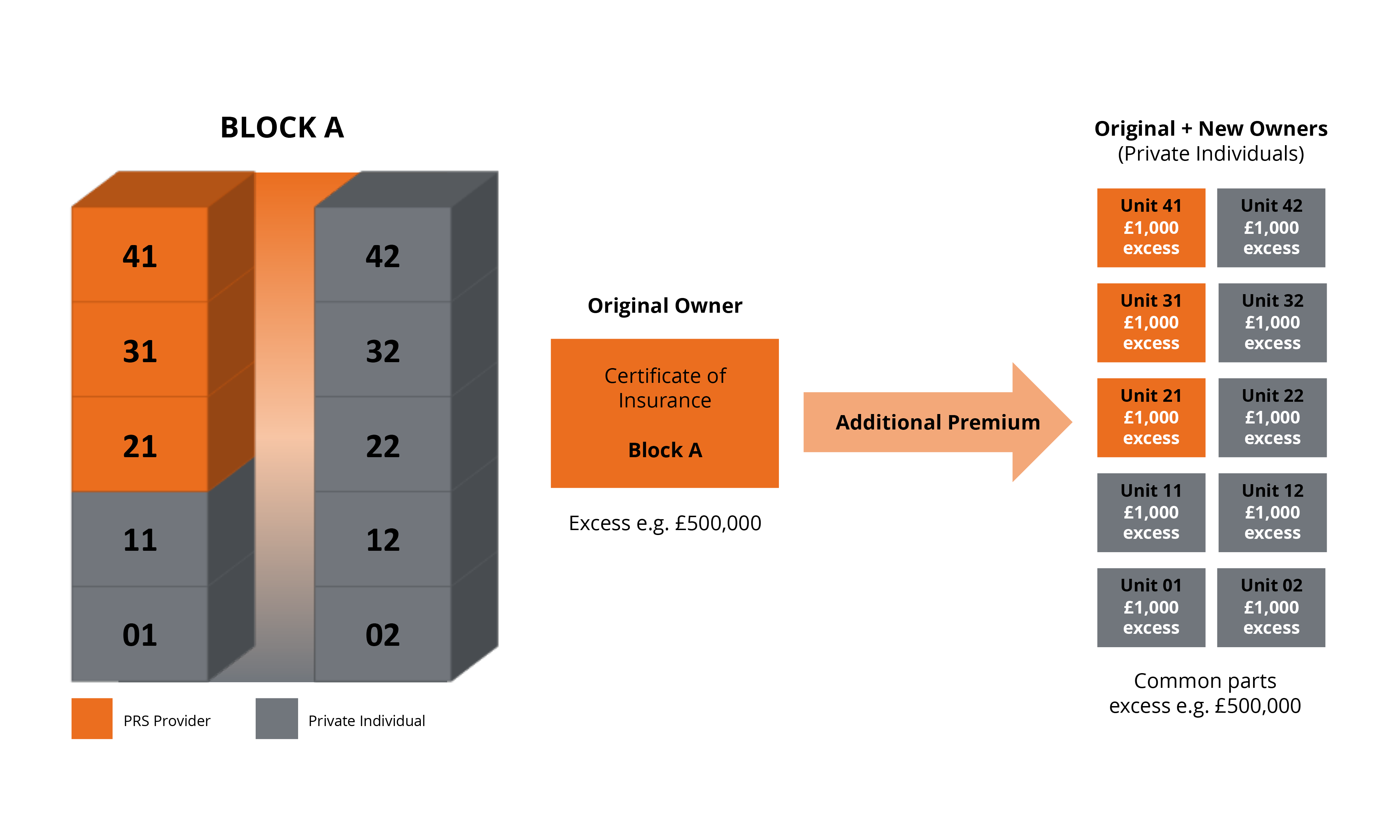

After two years from completion, the policyholder can sell all or any part of the development to new owners and the balance of warranty cover is transferred to them. Excesses can be varied through additional or reduced premiums and all transfer fees are known up front, so you can plan ahead. If you don’t transfer, there’s no fee to pay.

This makes Private Rental Select the ideal structural warranty cover policy for build-to-rent schemes that may be part of an owner’s or investor’s future divestment strategy, or where rent-to-own units are included.

Examples of Private Rental Select in use:

Example 1: The development is sold in its entirety to a new owner

Example 2: In this case, the developer sells to the individual unit residents

Example 3: Here, the developer sells part of the development to individual residents and retains part

With appropriate planning and support, build-to-rent schemes can provide high-quality housing at scale that offers tenure security, encourages community and has a positive effect on neighbourhoods.

Private Rental Select offers a structural warranty solution to suit.

- Read more about Private Rental Select here or download our Guide to Services brochure.

- Ready to apply for a quotation? Fill in our online form.